6 months performance report

It is now late June, time to take a look at how our solar installation has been performing over the last six months. To recap, the system is a 5.2kW rooftop installation using 22 240W Sunpower ACPV panels with integrated microinverters (see detailed writeup at http://kuzyatech.com/going-solar). It was turned on in early December of 2013 and has been pumping energy since then. So what did we produce so far?

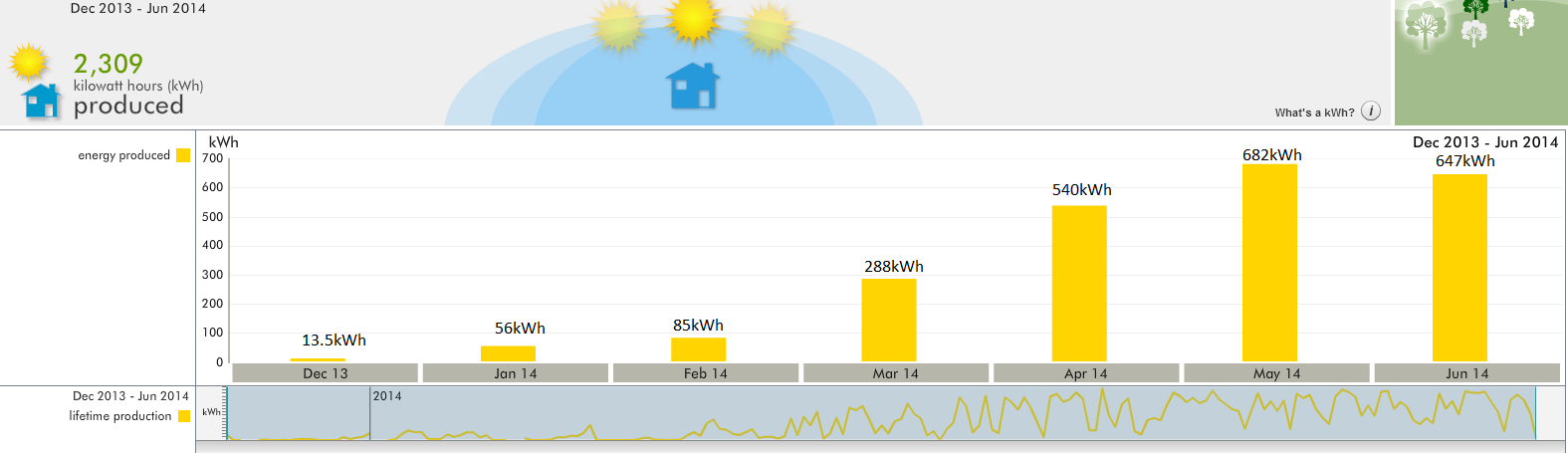

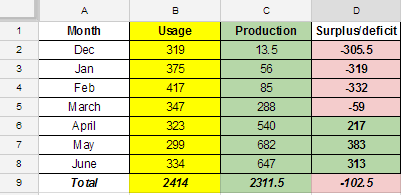

So far we’ve only really had four productive months as winters here are rather snowy. It took a lot of patience to wait for spring and to hope things would improve. At the end of February we accumulated only 154kWh, but once snow melted the output started climbing. I did attempt rooftop expeditions more than a few times to clear off the panels, but after about tens snowstorm with a foot or more of snow I just gave up. The amount of available energy was not worth the risk. So as of today we are at 2309 kWh produced over six calendar months. To put it in perspective, our energy usage over the same time amounted to:

We are essentially balanced at midpoint in the year. From here to December we should hopefully have mostly surplus of energy.

Financial side of things and net metering.

So how did this look on my electric bill? Every month I’d send the readings online, only to be followed a couple days later by the reading by the utility’s meter reader. It appears grid connected customers get special attention and require the company to read the meters monthly. Oh well. Then they would calculate usage minus production and charge me for the difference. If production exceeded usage, I’d see zero charge for electricity and the surplus would be added to the annual surplus “bucket”. In early spring that “bucket” is counted and I am paid for the surplus.

The one catch that’s not advertised a lot though is you get paid not at the retail rate but at the bulk (aka avoided cost) rate that the utility pays for its energy supply. It kinda makes sense, but ends up being $0.043 /kWh , while the retail rate is around $0.11 here. There is also this pesky little thing called “Customer charge” of $21.38 a month that the utility charges us for being tied to the grid and using it to shuffle energy back and forth.

Conclusion (s)

Overall we are pretty happy with the system as it’s doing exactly what it was designed to do- offsetting our energy use. But where does that leave us financially? If we assume little to no surplus, but full offset of usage, we are looking at $256 annual electricity cost. With any luck it will not follow the rates going up. So we’ll be somewhat insulated from changes in electricity cost for the foreseeable future. If on top of that we eek out some surplus, ideally it should be used to offset other, more expensive utility costs, such as space/water heating or charging an EV. And of course selling to the utility at the bulk rate would be the least preferred option, at least with current netmetering rules in New York state. And in case you are wondering, to offset the monthly grid tie fee would require almost 500kWh surplus monthly- not likely to happen with the currently sized system.

On the other hand, this data also shows the importance of properly selecting the netmetering anniversary date.You want it to be at the point in the year when you’ve accumulated and used up any surplus you had, but not earlier. Thinking from cash flow point of view- any money spent on kwh delivered will take 3x kWh produced to recoup. So if your year starts in December like mine initially did, for a good three months you’ll be paying for electricity and not getting that back any time soon.By the time next anniversary rolls around, you’d be sitting on a lot of surplus electricity which will then be paid for at the low bulk rate. And then you’d start paying again for the spring months. If on the other hand the anniversary is around April (which is where I eventually moved it to), you start off by producing surplus, go into winter with reserves and just about deplete them by next Spring. In the process the only cash outlay is the $21 customer grid connect fee every month.